Nubank

100 MB

9.15.92-minApi28

5.1

5,000,000+

Description

Introduction

Founded in 2013, Nubank has quickly become one of the most popular digital banks in Latin America, particularly in Brazil. Its mission is to fight complexity and empower people to take control of their finances. Nubank offers a range of financial products, including a no-fee credit card, a digital payment account, and personal loans, all accessible through its sleek mobile app.

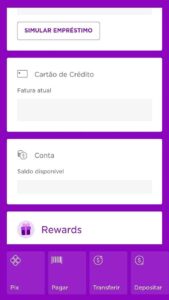

Interface of Nubank APK latest version

One of Nubank’s standout qualities is its intuitive and aesthetically pleasing interface. The app is designed with the user in mind, ensuring that navigation is seamless and straightforward. Key aspects of the interface include:

- Clean Design: The app features a minimalistic design that avoids clutter, making it easy for users to find what they need without unnecessary distractions.

- Ease of Navigation: With clearly labeled tabs and a logical layout, users can effortlessly access different sections such as account details, transaction history, and customer support.

- Customizable Dashboard: Users can personalize their dashboard to prioritize the information and features that are most important to them, enhancing their overall experience.

- Interactive Elements: The app includes interactive elements like graphs and charts that provide a visual representation of spending habits and financial health, making it easier to understand and manage personal finances.

What outstanding features does the application have?

Nubank’s app is packed with features designed to make banking more accessible and user-friendly. Some of the most notable features include:

- No-Fee Credit Card: Nubank’s flagship product is its no-fee credit card, which offers competitive interest rates and can be managed entirely through the app.

- Digital Payment Account (NuConta): NuConta is a digital payment account that allows users to make payments, transfers, and deposits with no fees. It also offers a high-interest savings account.

- Personal Loans: Users can apply for personal loans directly through the app, with transparent terms and conditions and quick approval times.

- Real-Time Notifications: The app sends instant notifications for all transactions, helping users keep track of their spending and detect any unauthorized activity immediately.

- Expense Categorization: Nubank automatically categorizes expenses, providing users with detailed insights into their spending patterns and helping them budget more effectively.

- Customer Support: Nubank offers 24/7 customer support through the app, with a responsive chat feature that connects users to real customer service representatives.

User Feedback and Ratings – Nubank APK 2024 for Android available for free download

Nubank has received overwhelmingly positive feedback from its users, reflected in its high ratings on app stores. Key points of praise include:

- User-Friendly Experience: Users appreciate the app’s simplicity and ease of use, which makes managing finances less daunting.

- Transparency and Trust: Nubank’s commitment to transparency, with no hidden fees and clear communication, has earned the trust of its customers.

- Efficient Customer Support: The responsive and helpful customer support team has been a highlight for many users, making them feel valued and supported.

- Innovative Features: The app’s innovative features, such as real-time notifications and expense categorization, have been praised for their practicality and usefulness.

Conclusion

Nubank is redefining the banking experience with its innovative, user-friendly app that puts control back into the hands of consumers. By offering no-fee financial products, transparent services, and a seamless interface, Nubank has set a new standard for digital banking. Whether you’re looking to simplify your finances, save money, or gain better control over your spending, Nubank provides the tools and support you need.

FAQs

Q: Is Nubank available outside of Brazil?

A: Currently, Nubank primarily serves customers in Brazil, but it has expanded its services to Mexico and Colombia.

Q: How can I apply for a Nubank credit card?

A: You can apply for a Nubank credit card directly through the app by providing some personal information and going through a quick approval process.

Q: Are there any fees associated with Nubank’s services?

A: Nubank prides itself on transparency and offers many of its services with no fees, including its credit card and digital payment account.

Q: How secure is the Nubank app?

A: Nubank uses advanced security measures, including encryption and real-time notifications, to ensure that your financial information is protected.

Q: Can I use Nubank for business accounts?

A: Currently, Nubank focuses on personal banking services, but they are continuously expanding and may offer business solutions in the future.

Nubank’s commitment to simplifying banking through technology and innovation makes it a standout choice for anyone looking to modernize their financial management. Download the Nubank app today and experience the future of banking.

Images